DKosig Since I first rated Preformed Line Products Company (NASDAQ:PLPC) a ‘buy’ in November of 2022, the overall performance of the company has been quite strong. Shares are up 56.8% since then, comfortably outperforming the 40.1% rise seen by the S&P 500 over the same window of time. As great as this is to see, this is no longer as impressive as it once was. You see, back in October of last year, I reiterated the ‘buy’ rating that I had on the stock. But from that window through today, shares are actually down 5.5%, significantly trailing the 25.9% surge seen by the broader market. For the company, which focuses on creating goods centered around power conductor and fiber communication cables, protective closures used for fixed line communication networks, and more, this is rather disappointing to see. But when you look at the fundamental data provided by management as of late, it’s not all that surprising. Revenue has been on the decline now, and profits and cash flows have taken a beating. On a forward basis, shares look fairly valued at best. Though relative to similar firms, the stock is still attractively priced. Ideally, I would like to see further upside from the business. At some point, this almost certainly will happen. But in the meantime, there likely are better opportunities than investors can search for. Tough times Before we get into the most recent data provided by management, I think it would be helpful and instructive to look at financial results covering the 2022 and 2023 fiscal years. After all, when I last wrote about the firm, we only had data covering through the second quarter of last year. So understanding how the picture has evolved is important. During 2023, revenue for the business came in at $669.7 million. That’s actually 5.1% above the $637 million generated one year earlier. Author – SEC EDGAR Data Most of this growth came from the company’s Asia Pacific region. Revenue of $102.9 million was a whopping 15.8% above the $88.9 million generated just one year earlier. According to management, this was largely because of volume increases involving energy products that were sold. Another growth area for the company was the EMEA (Europe, Middle East, and Africa) set of regions. Sales grew by 10.1%, climbing from $122.7 million to $135.1 million. Volume increases, not only involving energy products, but also communication products, contributed much of this upside. Meanwhile, the largest segment of the company, PLP-USA, reported a modest 1.6% increase. This took revenue up from $340.3 million to $345.6 million. Price increases, combined with higher energy product sales, more than offset declines in communication products. That decline, management asserted, was mostly due to inventory destocking of its customers. The only true weakness came from its operations in the Americas. Revenue rose by 1% from $85.2 million to $86.1 million. But all of this was because of foreign currency fluctuations. Without this, revenue would have fallen by roughly $0.9 million because of volume declines in the communications category. With the increase in revenue came a rise in profitability as well. Net income for the company grew from $54.4 million to $63.3 million. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, soared from $26.2 million to $107.6 million. If we adjust for changes in working capital, the rise was more modest but still impressive, with a metric climbing from $79.8 million to $94.4 million. Finally, EBITDA for the company expanded from $93.2 million to $103.8 million. Author – SEC EDGAR Data Based only on the data involving 2023 relative to 2022, you might think that there is nothing negative going on about the business. But that changed in 2024. For the first quarter of the year, revenue totaled only $140.9 million. That’s down 22.5% from the $181.8 million reported one year earlier. This was attributable to three of the four areas of the company that I wrote about previously. For instance, sales associated with PLP-USA plunged 27.2%, dropping from $97.2 million to $70.7 million. The company saw lower volumes across the board, and it suffered from unfavorable product mix. The percentage decline for the EMEA regions was nearly as bad, coming in at 26.6%. That drop from $39 million to $28.7 million was driven mostly by weakness in the communications category. But management did say that energy product sales also suffered here. Another big weak spot involved operations in the Americas. Revenue of $18.4 million happened to be 18.7% below the $22.6 million reported just one year earlier. Once again, lower volumes in the communications space were problematic for shareholders. The only bright spot involved the Asia Pacific region, with revenue inching up 0.5% from $23 million to $23.2 million. Despite significant headwinds involving foreign currency fluctuations, the company benefited from volume increases in the energy products category. To be fair, management had been warning about weakness coming in this market since about the middle of last year. In their latest quarterly earnings release, the company attributed this to softness in end market demand because of multiple factors, including not only higher inventory levels, but also because of delayed BEAD stimulus funding and the impact that high interest rates have had on spending. Unfortunately, management has not provided any outlook regarding when this market will turn around. But they did say that they remain excited about market conditions in the long run. Obviously, investors should expect weakness to continue for at least a couple of quarters. In the meantime, it wouldn’t be surprising to see shares continue to underperform the market. We don’t really have any idea what results will look like for the rest of 2024. But if we annualize results seen so far for the year, we would anticipate net income of $28.4 million, adjusted operating cash flow of $50 million, and EBITDA totaling $60.3 million. Author – SEC EDGAR Data If we take these figures, as well as historical results from 2023, we can see how shares are priced as shown in the chart above. Using the 2023 figures, the stock is still attractively priced. But things do look less ideal on a forward basis. These are the kind of multiples that I would associate with a company that is more or less fairly valued. Relative to similar firms, that appears to be the case as well. In the table below, I compared Preformed Line Products Company to five similar companies. If we use the historical results from 2023, we can see that Preformed Line Products Company is cheaper than any of the other firms. But on a forward basis, three of the five companies are cheaper than it using both the price to earnings approach and the price to operating cash flow approach. Meanwhile, using the EV to EBITDA approach, we can see that only one of the five companies is cheaper than our target. Company Price / Earnings Price / Operating Cash Flow EV / EBITDA Preformed Line Products Company (2023) 10.1 6.8 6.3 Preformed Line Products Company (2024 Estimates) 22.5 12.8 10.8 Powell Industries (POWL) 18.9 8.5 12.3 GrafTech International (EAF) 43.8 6.9 10.6 Thermon Group Holdings (THR) 20.1 15.5 12.1 Shoals Technologies Group (SHLS) 37.8 12.2 17.9 Acuity Brands (AYI) 21.0 14.0 12.6 Click to enlarge Takeaway Even though I was aware that industry conditions were weakening, I did not think that the pain would be this significant. The good news is that, even on a forward basis, shares look more or less fairly valued. So downside from this point on is probably limited. For those focused on the long haul, buying now and waiting for the pain to be over might not be a bad idea. But in the meantime, there could be other opportunities that investors put their money to with greater effect. Given this, I don’t think the downgrading the company to a ‘hold’ is out of line. Having said that, if we start to see signs of improvement, the picture could turn around for the company very quickly. So investors would be wise to keep a close eye on matters moving forward.

sekar nallalu Cryptocurrency,Daniel Jones,PLPC Preformed Line Products Company: Downgrading Shares On New Weakness (NASDAQ:PLPC)

Related Posts

States Should Get 60 Per Cent Share Of GST, Says Kerala FM During 53rd GST Council Meeting

It was decided in the meeting to include in the GSTR-8 return the details about the state to which the[...]

Discover the health and eco-friendly perks of silk bedding

Within the realm of bedding, silk is often seen as a luxurious, prestigious option that offers unparalleled softness and smoothness.[...]

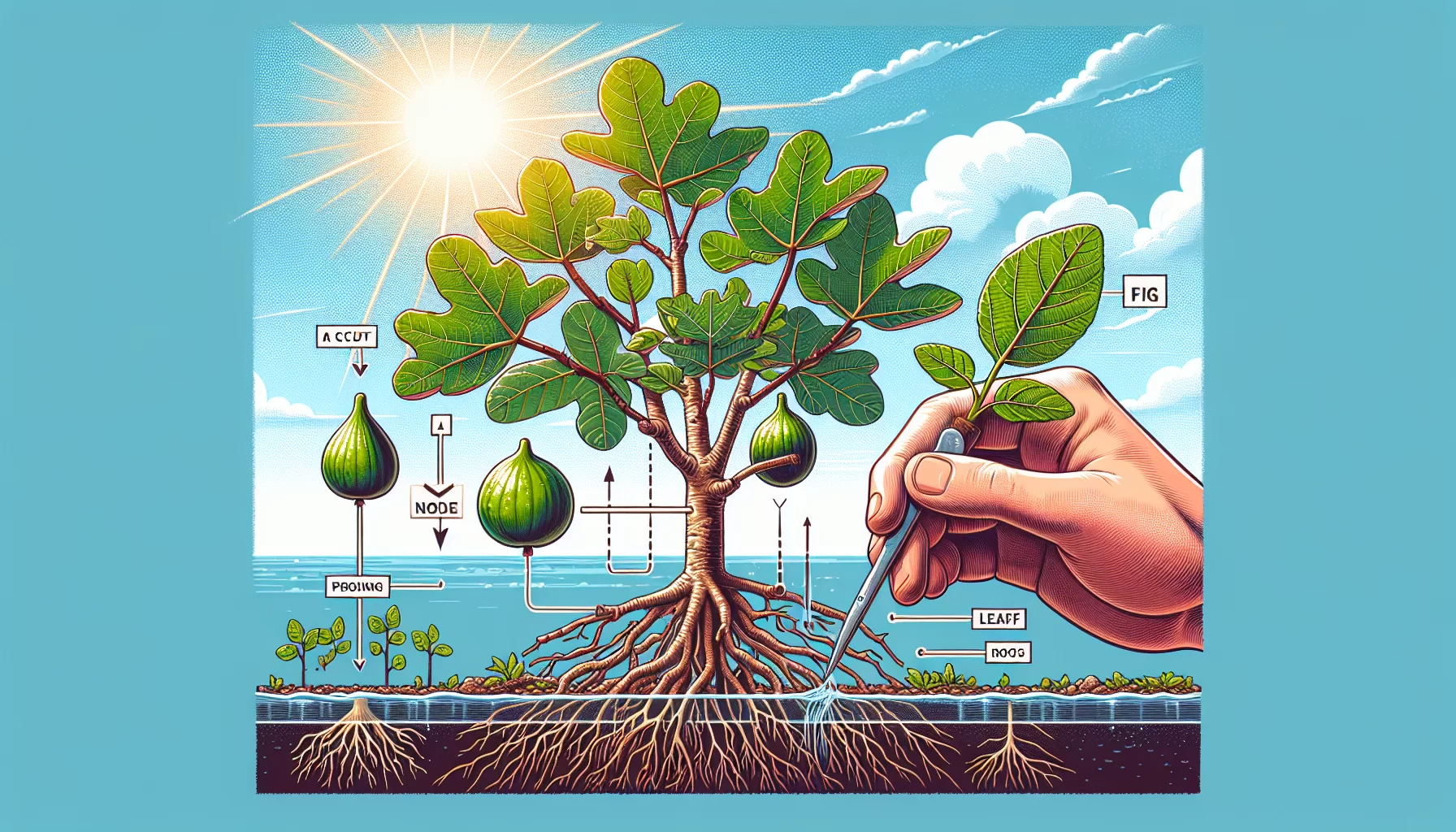

Fig propagation: a sustainable approach to grow your own fig tree

Welcome to the fascinating world of fig propagation! In today’s article, we’re going to delve into a method that allows[...]