SusanneB Introduction I’ve been keeping tabs on Seneca Foods (NASDAQ:SENEA) (NASDAQ:SENEB) and I’ve written two articles about the company on SA to date. The latest of them was in November 2023 when I said that the high margins were not sustainable and that rising net debt levels could limit share repurchases. On June 13, Seneca Foods released its results for Q4 FY24 and I think they were mixed. Higher selling prices offset a lower sales volume and the net loss came in at just $2.2 million compared to $33.1 million a year earlier. However, using the First-In, First-Out (FIFO) inventory valuation method, EBITDA went down by 22.7% year on year. In my view, this confirms my thesis about the unsustainability of high margins, and I’m keeping my rating on Seneca Foods’ stock at hold. Let’s review. Overview of the Q4 FY24 financial report In case you are unfamiliar with the company or my earlier coverage, here’s a brief description of the business. Seneca Foods was founded in 1949, and it focuses on the production of canned vegetables (around 80% of revenues) in the USA. It also manufactures packaged fruits, snack chips, sauces, gravies, and natural colorants. The company has a network of 26 facilities across the USA, and they include packaging, can manufacturing, and seed production plants, a farming operation as well as a logistical support network. The brands of Seneca Foods include Seneca, Libby’s, Green Giant, Aunt Nellie’s, and CherryMan among others. It has two classes of shares and the difference between them is that class A stock has voting rights of 1/20th of one vote per share, while class B has a full vote per share. Seneca Foods Overall, the company operates in a highly competitive seasonal business where strong sales and net earnings are recorded during the second and third quarters of the fiscal year. The sales of Seneca Foods peak in the third quarter of the fiscal year as a result of increased retail demand during the holiday seasons, and inventories tend to peak during mid-autumn when corn and green beans are harvested. There is minimal food packaging in the fourth quarter, and this is when Seneca Foods usually carries out repair and maintenance activities. In view of this, I was surprised that the loss of the company for Q4 FY24 shrank so much compared to a year earlier. While net sales went down by 7% year on year to $308 million, the effect of this on operating margins was offset by higher selling prices. Digging deeper, it’s important to note that the company uses the last in, first out (LIFO) inventory valuation method, and this decreased operating income by $2.7 million compared to $52.3 million a year earlier. In addition, Q4 FY23 had $1.3 million higher restructuring expenses due to plant closures. Seneca Foods Using the internationally dominant FIFO method, EBITDA for Q4 FY24 was $23.1 million, compared to $29.8 million a year earlier. Overall, the results of Seneca Foods for the quarter only look good if you don’t switch the accounting method. Turning our attention to the balance sheet, net debt soared to $632.6 million from $470.5 million a year earlier as inventories rose by $201.8 million due to rising raw materials costs. In addition, the company invested $33 million during FY24 in share buybacks. Overall, I’m concerned about the debt burden of Seneca Foods, considering the weighted average interest rate on its revolving credit facility was 6.93% compared to 6.34% a year earlier (page 5 of the Q4 FY24 financial report). Seneca Foods Future of the company and valuation Seneca Foods operates in a mature business with low margins and as you can see from the table below, its revenues have barely grown over the past decade. Operating income levels have been erratic, and they have been sensitive to price fluctuations of vegetables. Using the LIFO method, FY24 was strong in terms of EBITDA but switching to the FIFO method makes the numbers look underwhelming. In my view, FY25 revenues and EBITDA using the FIFO method are likely to be at similar levels to FY24 considering this is a mature business that isn’t sensitive to macroeconomic cycles. With net debt rising, I expect net income for FY25 to decrease in the low double-digit percentage digits. Debt levels and interest expenses should increase significantly in Q2 and Q3 FY25 due to peak inventories, and I think this could limit share buybacks in the coming months. Seeking Alpha Seneca Foods Turning our attention to the valuation, we can see that Seneca Foods is trading at 6.7x EV/EBITDA and a similar level for P/E. These levels haven’t been this low for over a year, and the price to tangible book value is at 0.7x. Overall, the company doesn’t look expensive based on historical financial multiples but it’s not particularly cheap either. With a lack of potential positive catalysts on the horizon, I think investors should avoid Seneca Foods’ shares at the current levels. Seeking Alpha Investor takeaway The financial results of Seneca Foods for Q4 FY24 look strong using the LIFO method, but the picture doesn’t look good when you switch to the FIFO method. This is a mature business with low growth and erratic operating margins. While the argument could be made that Seneca Foods undervalued as it’s trading at just 0.7x price to tangible book value, the counterargument is that this ratio has surpassed the 1x mark for only a few days over the past decade. With no positive catalysts for the business on the horizon, I think that Seneca Foods could be a value trap and that there are much better investment opportunities on the market at the moment. Overall, I don’t plan to open a position here unless the price to tangible book value ratio drops to something like 0.6x.

sekar nallalu Cryptocurrency,Gold Panda,SENEA,SENEB Seneca Foods: Q4 FY24 Results Look Strong Only Using LIFO (NASDAQ:SENEA)

Related Posts

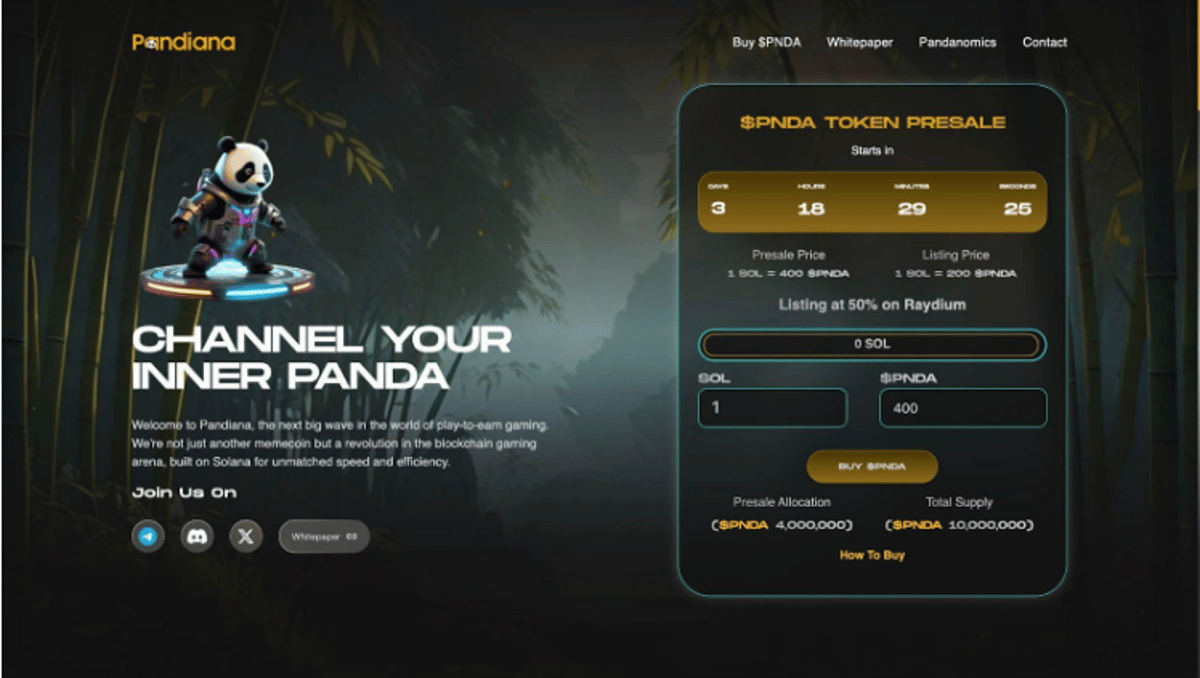

Pandiana Set To Become The Top Solana Memecoin With Play-To-Earn Utility

Limited Supply That Ensures Value: Pandiana caps its total token supply at , ensuring rarity and enhancing potential value retention[...]

Coinbase CLO Criticizes SEC Settlement with Kwon, Terraform

Coinbase’s Chief Legal Officer, Paul Grewal, has criticized the Securities and Exchange Commission’s (SEC) $4.47 billion settlement with Do Kwon[...]

DOJ Charges Epoch Times Exec with Laundering $67M Using Cryp…

The US Department of Justice (DoJ) indicted Bill Guan, the chief financial officer of Epoch Times, on Tuesday. The DOJ[...]