panida wijitpanya By Mike Larson, Editor-in-Chief, MoneyShow Mary Ellen McGonagle, Senior Managing Director of Equities at Simpler Trading and Editor of the MEM Edge Report, covers the outlook for the stock market, standout sectors like technology, and why the AI boom is not like the Dot-Com Bubble all over again. Transcript Larson – Hello and welcome to our latest MoneyShow MoneyMasters Podcast segment. I’m Mike Larson, Editor-in-Chief at MoneyShow. And today, I’m pleased to welcome a brand-new guest to the show. She is Mary Ellen McGonagle, Senior Managing Director of Equities at Simpler Trading and Editor of the MEM Edge Report I know a lot of people follow your work on YouTube. So probably a lot of the people who see this will know what it is you do. But just briefly, since I haven’t had you on the show before, talk a little bit about your background and what it is that you do. McGonagle – Yeah, you bet. I started out in the ranks years ago on Wall Street, on the trading desk for fixed income at Goldman Sachs. From there, I — this was on the institutional sales division, I went over to what’s called the buy side, and my career was continually elevated to the point where I was managing $2 billion in assets. I eventually moved out here to Los Angeles on the West Coast. I joined William O’Neil + Company, where I worked with institutional money managers around the world, teaching them the O’Neil methodology, which is all about uncovering these big, winning stocks just as they take off. And I’ve taken that approach with my current MEM Edge Report. I’ve been the author of that for over eight years now and had great success. It’s been just a lot of fun to share that knowledge with self-directed investors. I do still have a couple of institutional clients, but my primary focus is helping individuals. Larson – Great. I appreciate the background there. Let’s dive right in and talk about this market. I mean, as we’re recording, it’s another day where — Nvidia (NVDA) – the stock nobody owns and nobody’s ever heard of, the biggest stock in the marketplace. What are your thoughts on the market, Nvidia in particular, but just the broad averages that are being led by tech here? McGonagle – Yeah. So with my work, of course, the markets, the Nasdaq, the S&P 500 are hitting new highs. Over the last several weeks, however, the progress and the participation in the market has been very focused. It’s been certainly technology, large-cap tech, and AI-focused. However, this week, over the past two days, Monday and Tuesday, it has developed that we’re seeing a broadening out. We’re seeing a move back into some of these industrial stocks, which is great news. We want to see participation spread. Bank names coming on a little bit. They’re not ready for prime time yet. But even within those industrials, it is going to continue to be AI-related at this point in time. But we are seeing a nice move back into that group. We did get some very constructive economic data on Monday that’s telling us that the industrial production number was the highest in ten months. So, we are seeing a broadening out beyond those AI names as well. I know I have a couple of big winning stocks in that area that still look to have positive upside price action ahead of them. These are names that I put on my suggested holdings list, where I identify stocks just as they’re taking off, and then as they continue to advance, advising those buy points. Larson – Got it. Well, let’s talk about sectors. I know a lot of the work that you do on YouTube and that I’ve seen in your report is very focused around not just looking at the S&P, but just looking at what’s happening with the 11 sector groups. When you analyze the market now, where are you seeing some of the best kinds of technicals and best prospects, and where do you think there are areas of the market people might want to stay away from at this point? McGonagle – Yeah. So it is going to be AI-focused with my MEM Edge Report I do. Technology, of course, is hitting a new high. It’s been just on fire over the last couple of weeks and beyond. And within that, I have about five semiconductor stocks that I picked as those names poised to outperform. Three of them are in the top-performing stocks this week within the Nasdaq. So, when you’re looking at the markets, and you can see strength in, for instance, semiconductors, it’s really important to be selective. It’s not going to be just throw a dart. You do want to get those names that are best positioned to really grow. They’re either equipment or they’re chip manufacturing companies that are focused again on AI developments. So, that’s one area. And then there have been opportunities, but there are some names that are newer to this move. And Lam Research (LRCX) is a name that I added last Sunday, and it’s gone up probably about 6%. But looking at that chart, it still has further upside. So, that’s the type of move that I’m on the lookout for. In addition, of course, to Nvidia and buying on those pullbacks, you’re going to have these names that are first out of the gate. They’ll continue to lead. But then as the group progresses, you’re going to want to be able to identify those follow-on names that have high-growth prospects and a great-looking chart. Larson – Got it. Okay. If you step outside of the tech, there are other parts of the market. You did touch briefly on industrials and financials as a couple of areas. Is it an improving backdrop? Or would you like to see more progress? McGonagle – Sure. So, as I mentioned, we are seeing a little bit of movement in bank stocks, but they’re just not ready for prime time. That’s going to be the primary group within those financials. I talked about industrials coming into play. But then you can also move over to communication services. And Netflix (NFLX) is another recent stock that I added to my buy list on Sunday. And it has everything to do with a media report that they are really seeing high viewership among their streaming activity. This has investors encouraged because when Netflix reported their earnings, they stated that they were going to stop providing subscribership numbers. So the stock really pulled back. And then this time, it did re-enter an uptrend. So, that would be an area that’s as it relates to outside of technology. Larson – Yeah. I may or may not be someone who occasionally streams programing on Netflix. I’m not going to give away the total hours of viewership per month. I’d probably be scared of the number if I looked it up, but… McGonagle – That’s funny. Yeah. Larson – In any event, let’s talk a little bit about the Fed and some of these macro things people are talking about. You obviously have followed the fixed income markets for a long time. What are your thoughts on the Fed and interest rates and how that’s going to impact the backdrop for stocks overall as we head into the second half? McGonagle – Yeah, that is of course a great question. All eyes are on interest rates. We have seen them recede. I pay close attention to the yield on that 10-year, and it’s down at about 4.2%, which is constructive. That is what last week led to that nice move back into growth stocks. And then again, another sector that’s coming on this week is consumer discretionary. But relative to interest rates, very critical in a lot of my work. Each week, I will cite the broader markets and then post an overlay of the yield on that 10-year. Because there are key levels that are really relevant as far as if rates get back up into that 4.5% level, the 10-year, we could see a pullback again in interest in growth stocks. And next week, investors do want to be aware the core PCE data is due to be released. And that’s a very critical number for the Federal Reserve in identifying whether inflation has receded. We’ve seen numbers recently and that it is pulling in good news there. But you cannot fall asleep at this point. Stay alert. Larson – Absolutely. Let me ask you a question about sentiment. I mean, you’ve seen all kinds of markets throughout your career. People are euphoric, people are despondent and everything in between. How would you characterize us right now? Are people getting too bold up here? Is that an obstacle? Or do you think that this run is not really being opposed by sentiment? McGonagle – Yeah. So, for that, I’m going to be paying close attention to volume. And so, some of the names that I mentioned to you, like Netflix, Lam Research, their advances and moves back into uptrends are taking place on volume. And when I see heavy volume in these larger cap names, it indicates potential institutional sponsorship and these institutions coming in. That’s what you want to see if you are looking for a stock that then can go on to outpace the broader markets. Now relative to investor sentiment streaming down, I don’t have a lot that I look at out there. Again, volume is going to be my key indicator. That is going to be one of the factors to take into account when putting stocks on my buy list. Larson – Got it. And that actually segues nicely into what I was going to kind of wrap things up with here towards the back end of the conversation was your technical analysis and the kinds of signals that you’re looking for. When you’re talking to people, again on YouTube or face-to-face at conferences like ours, what are some of the most important things you’re trying to educate them about in this market environment? McGonagle – In this current market environment, it’s really paying attention to breath in the markets. Are we seeing movement beyond the funneling into those big, mega-cap growth names that are AI-related? I want to see participation broaden out because, in turn, that will keep the prospects of the current uptrend remaining. Keep those prospects in place. Now, we have had periods where we have seen that funneling in, but by and large, more participation is going to really help the markets continue to trade higher. Larson – Got it. And I guess I’ll wrap things up by mentioning one of the reasons we’re talking. You’re going to be joining us at the MoneyShow Masters Symposium Las Vegas. It’s in August. And officially – and I always say that the speakers give these topics so far in advance. The markets obviously can change. But you’re going to be talking about “AI-related stocks for the long run and top ways to position your portfolio.” Any kind of sneak peek that you might want to tell people here, so they know a bit about what they’re going to be getting the full story on in August? McGonagle – Yeah, that is a great question. And actually, what I am focused on as it relates to AI at this point in time is the fact that the move into those stocks is real. I was around during the Internet bubble – ’99, into 2000, feels like it was just yesterday. What I’m highlighting to investors is the fact that a lot of those Internet names were in what was, of course, called the bubble, and they were not real companies. They did not have earnings. Many of them are no longer in business. This particular move into this AI-related area is real. We are having companies that are coming out. They’re reporting growth. They’re seeing demand. So, it’s a much different backdrop and the environment gives me quite a bit more confidence because I combine those technicals on the chart with the fundamentals. I need to see those growth prospects. Larson – Well, Mary Ellen, thanks again for your time. McGonagle – Great seeing you. Originally published on MoneyShow.com

sekar nallalu Cryptocurrency,LRCX,MoneyShow,NFLX,NVDA McGonagle On Tech Stocks, Key Indicators, The AI Boom And Market Outlook

Related Posts

Macau Casino Mogul Alvin Chau Loses Final Appeal, Faces 18-Year Sentence

In the latest turn of events, Macau’s apex court has once again slammed the gavel against the fallen gambling emperor[...]

BlockDAG’s $50.8M Presale Eclipse Shiba Inu And Super Trump

BDAG coins are vital to BlockDAG’s ecosystem, facilitating transactions, rewarding network participants, and supporting diverse dApp functionalities. With ongoing innovations[...]

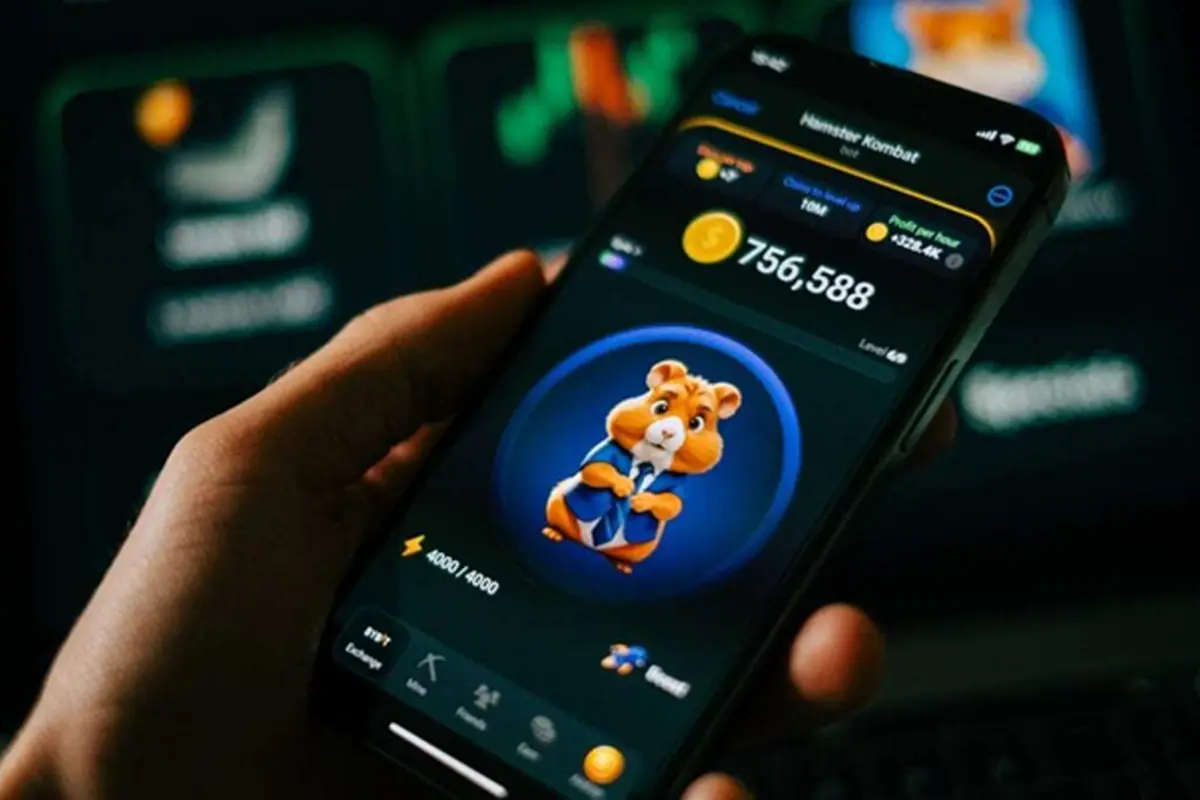

Hamster Kombat Token Launch Echoes Buzz Across P2E Crypto Se…

Hamster Kombat, a Telegram-based tap-to-earn game, has recently gained significant traction across the crypto realm. Soon after its inception, the[...]