adventtr The theme of the past couple of weeks has been the S&P 500 pressing higher in spite of weak breadth. Today, the script has flipped, as the S&P 500 is down only a few basis points even though breadth is strongly positive with advancers outnumbering decliners better than 3 to 1. The decliners are being led by a key area of the market: the semis. With the likes of Nvidia (NVDA) down 5% on the day (and down 14% since last Tuesday’s high), the semiconductor ETF (SMH) is testing the uptrend that has been in place since its April lows. Since its closing high last Tuesday, SMH is down 7.2%. As shown above, although it’s a significant decline, it’s only a small dent in what has been an incredible rally over the past year. In fact, the ETF is still trading in overbought territory relative to its 50 DMA even after its recent decline. That still does not steal from just how large of a drop it has seen. In the chart below, we show the rolling 3-day percent change in the ETF since its inception in 2000. As shown, there was an even larger drop of 9.1% leading to the April bottom, but the current drop still ranks in the 2nd percentile of all 3-day moves on record. Original Post Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Related Posts

XRP/BTC Price Prediction: Why XRP Can Rally to $30

XRP price dropped 0.9% in the last 24 hours to trade at $0.474 during European business hours on Wednesday. The[...]

COVAL plunges 41% amid Coinbase delisting

Circuits of Value (COVAL) has witnessed a deep dive in its value as the Coinbase crypto exchange decided to suspend[...]

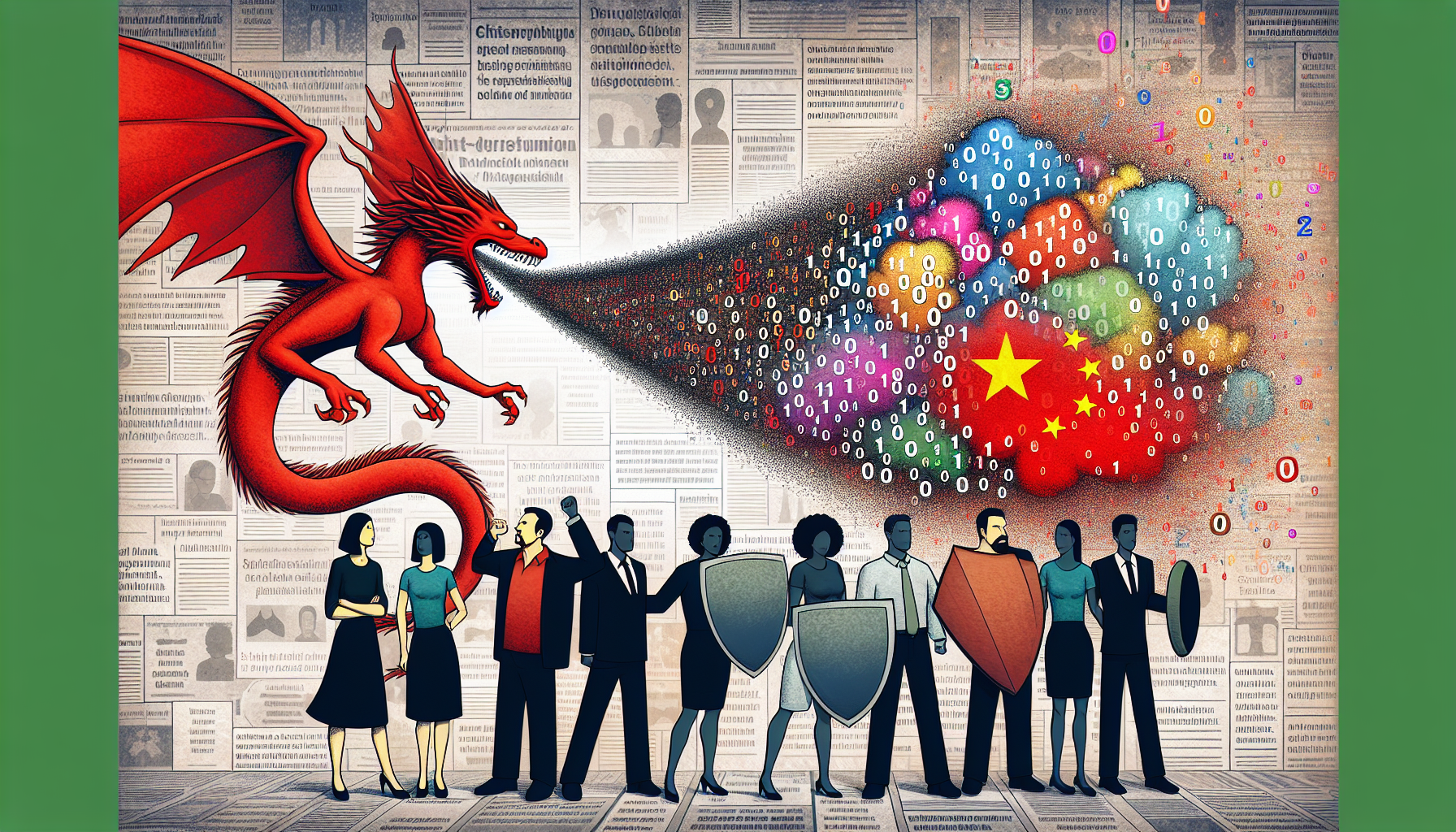

Unmasking China’s global disinformation campaign: a silent assault on dissent

The distortion information weapon of China As we delve deeper into the impact of our interconnected digital world, it’s become[...]