lzf/iStock via Getty Images Zumiez (NASDAQ:ZUMZ) is a retailer focused on streetwear and skater products. This article covers the company’s 1Q24 results and earnings call. The company’s results were mixed: sales were down on a comparable basis, but there were areas of positive comps in North America and men’s apparel. Despite some gross margin recovery, the company continues to post large operational losses. I started covering Zumiez in March 2024 with a Hold rating. Despite some aspects, I liked about the company, like management ownership, a history of growth, and a good branding strategy, I considered the stock did not sufficiently discount the company’s operational challenges. Since that article, the stock is up 20%, but I do not believe the improvement is justified by a significant fundamental shift. In my opinion, Zumiez is not an opportunity at these prices, and I maintain my Hold rating. However, I also consider that the company does not need super optimistic assumptions to generate an adequate earnings yield and could be considered fairly priced, or even a speculative Buy, for more aggressive readers. Mixed 1Q24, still on the red Zumiez Q1 results were mixed, with many negative aspects but some very positive ones. On the top line, the company is still posting negative comparable metrics, down 2.4% for the quarter. However, the topline also shows positive signs. First, North American sales (almost 80% of total sales) showed positive comp sales in the first quarter for the first time. Male apparel has been posting positive comps for two quarters. Second, when compared to similarly sized retailers competing in the same category, like Tilly’s (TLYS), which recently posted double-digit negative comps, Zumiez’s situation seems much better. The situation on the international front is much worse, with comparables down 13%, driven mainly by lower European sales. Like many retailers, Zumiez posted significant improvement at the gross margin level, over 200 basis points. This meant gross profits were higher than last year despite lower sales. Unfortunately, this did not help with operating losses, which amounted to $20 million or about 11.5% of sales. We should remember, though, that Q1 is a low seasonal quarter, which means Zumiez margins are particularly low. Data by YCharts Finally, the company commented that sales for fiscal May (to be included in 2Q) were flat on a comparable basis, with North America up and International down. The company is still expecting a flat to down second quarter though. I continue to believe that Zumiez is doing the right things on the business front. For example, despite the challenging situation, the company is not offering large clearances on its website, which is basically promotion-free. This is important to protect margins and profitable sales. The company continues to grow its social media followers by more than 10% between Instagram and TikTok since I last checked in March. The company continues to apply a correct organic branding strategy, for example by partnering with the goth influencers Sam & Colby for a meet and greet in Minneapolis. Expectations and updates to the model Zumiez management is cautious but relatively bullish for the year. The company has not posted guidance for fiscal 2024, but management mentioned on the 1Q24 call that it expects the year to show positive revenue growth and a positive operating margin. The second quarter is still expected to post negative comps and operational losses, though, despite the help of a back-to-school week from the third quarter last year. In my latest article, I provided a small napkin model for Zumiez’s profitability. The model moved lease costs from CoGS to SG&A so that CoGS represents more variable costs and SG&A represents more fixed components. CoGS is a proxy for volume sales, and the model works with several product margin assumptions. Data by YCharts I base my model on the TTM figures above with some adjustments. First, CoGS has to be reduced by $80 million (the approximate annual lease costs for Zumiez, based on their 10-K). Second, SG&A costs should increase by $80 million (to include lease costs) and decrease by $41 million because they include a non-recurring non-cash impairment in FY23. Finally, the product margins are about 10 percentage points above gross margins, given the weight of lease costs on sales. The model is posted below. Under the current gross margin (33% TTM) and CoGS scenario, the company would still post operating losses. To breakeven at current margins, it would need to grow sales by low single digits. Zumiez simple napkin model (Author) Valuation As seen below, Zumiez EV is significantly lower than its market cap given its significant cash reserves, without offsetting debt. The company announced in Q1 that it had authorized share repurchases for $25 million, but the timing is unclear. Data by YCharts As done in other articles, I like to invert the valuation and ask what expectations are needed to obtain a decent earnings yield on Zumiez’s EV. In this case, I believe a NOPAT yield of 10% or more is needed to justify buying Zumiez under relatively conservative assumptions. Depending on the reader’s risk aversion, that figure might be higher or lower. As we saw above, the company will still be in the red operational stage under the current margin and sales conditions. However, a small low single digit improvement in total sales volumes (particularly in comparables adding to store productivity) would put the company in positive operating territory. In order to post a 10% earnings yield for this year, the company should generate about $24.5 million in NOPAT, which implies comparable revenue improvements of between 5% and 10% and a product margin improvement of one to two percentage points. I do not think the above assumptions are particularly aggressive, but they are definitely not conservative. The consumer is still challenged, and Zumiez’s recovery has been short-lived so far, with only a quarter of positive comping in North America. In my opinion, the stock is still not opportunistically priced, given that it requires optimistic margin and revenue assumptions to generate what I consider an adequate earnings yield. However, some readers might consider it more opportunistic. Further, the company is performing better than its peers, which is indicative of its better management quality, as was commented on in this and the previous article. So far, I still consider Zumiez a Hold, albeit with the potential to be a speculative Buy for some readers.

sekar nallalu Cryptocurrency,Quipus Capital,ZUMZ Zumiez Business Is Improving And Reasonably Priced, But Still A Conservative Hold

Related Posts

Analysts Say Political Meme Coins to Remain Volatile as US P…

On-chain experts have warned that political-themed meme coins will remain volatile for the next seven days or more as the[...]

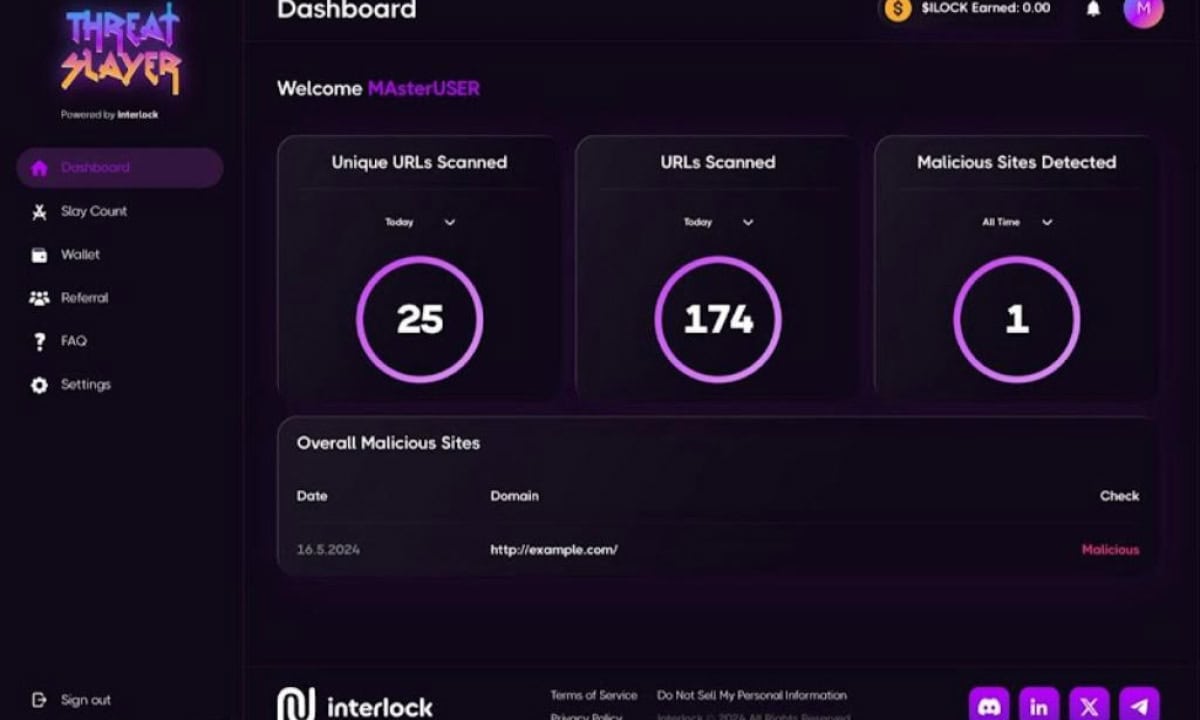

Interlock Launches ThreatSlayer Web3 Security Extension and …

[PRESS RELEASE – Fairfield, CT, USA, June 27th, 2024] Uses blockchain and Web3 to incentivize users to participate and share[...]

Whales Abandon Binance Coin and Solana for BlockDAG’s 1120% Surge: Here’s Why

Binance Coin (BNB) has generated excitement by defying the bearish market trend and hitting new all-time highs (ATHs). Recently, BNB’s[...]