fotoVoyagerElevator Pitch Korea Electric Power Corporation (NYSE:KEP) [015760:KS] is still rated as a Buy. The two key catalysts I identified for KEP in my earlier article published on March 14, 2024 are intact, which supports a Buy rating. My favorable expectations of Korea Electric Power reinitiating dividends and achieving an earnings turnaround this year remain unchanged. Last year, KEP was loss-making and didn’t distribute dividends. Korea Electric Power will be deserving of higher valuation multiples, if the company delivers positive earnings and resumes dividend payments as per my expectations. Earnings Turnaround Catalyst With my prior mid-March update, I noted that “Korea Electric Power can become profitable again” thanks to “favorable power generation mix optimization with a shift towards nuclear power.” Analysts currently forecast that KEP will register an EPS of KRW5,193 (source: S&P Capital IQ) for full-year FY 2024 versus a FY 2023 net loss per share of -KRW7,152. It is noteworthy that the consensus fiscal 2024 EPS projection for Korea Electric Power was raised by +177% from KRW1,874 at the start of this year to KRW5,193 now. In other words, the sell side has become increasingly optimistic that KEP will be in the black again. Recent third-party research, management commentary, and media reports suggest that Korea Electric Power is likely to record positive earnings in 2024 and beyond as the company’s power generated from nuclear power grows. A June 17, 2024 research commentary issued by Fitch Ratings indicated that “high nuclear utilization rates and increasing nuclear generation capacity should widen KEPCO’s (Korea Electric Power’s) operating margin, as nuclear power has higher margin than thermal power.” KEP mentioned at the company’s first quarter analyst call (source: S&P Capital IQ transcript) last month that its “capacity factor of nuclear power slightly increased, resulting in a slightly higher contribution to the mix.” In specific terms, the company’s proportion of power generation derived from nuclear power rose from 45% in the first quarter of last year to 46% for Q1 2024. Korea Electric Power shared at its latest quarterly analyst briefing that its new “Shin Kori Unit 5 nuclear power plant” will “start commercial operations in October” 2024 which is expected to “increase the contribution of nuclear power” for the full year. Media publication The Korea Herald published a news article on June 3, 2024 highlighting South Korea’s goal of growing the share of “carbon-free energy sources such as renewables and nuclear power” as a percentage of “the country’s electricity supply portfolio” from 40% for the prior year to 70% in the future. This is consistent with KEP’s internal targets. In the company’s investor presentation slides, Korea Electric Power outlined its target of growing its renewable power (including nuclear power) capacity by +33% to 8.8GW in FY 2024. Looking beyond the current year, KEP aims to increase its renewable power capacity by +40% and 24% for 2025 and 2026, respectively. To sum things up, I am of the opinion that KEP is in a good position to realize an earnings turnaround taking into account the rising nuclear power generation contribution. Dividend Re-Initiation Catalyst I highlighted that “there is a good chance of dividend resumption” for KEP in my previous March 14 write-up. Firstly, Korean companies in general have become more shareholder-friendly with respect to dividend distributions Korean media outlet Maeil Business Newspaper’s latest June 24, 2024 commentary piece indicated that an increasing number of listed Korean companies are paying out dividends more than once per year. Specifically, the number of Korea-listed businesses distributing interim dividends rose from 46 for 2020 to 61 in 2021, before increasing further to 77 and 79 for 2022 and 2023, respectively. At the time that this Maeli Business Newspaper article was published, 14 listed Korean companies have announced that they will pay out dividends on an interim basis for the first time. Secondly, there could be new measures introduced to encourage Korean companies to distribute a growing amount of dividends. Asset management firm East Capital’s recent June 5, 2024 commentary identified “corporate tax deductions on incremental higher dividends, and reduced dividend income tax for shareholders” as potential new policies following its conversations with the country’s regulatory authorities. Korea Electric Power is a Korean utility company listed on both the NYSE and the Korea Exchange. A resumption of dividend payments becomes more likely for KEP, when listed Korean companies as a whole become more willing to distribute more excess capital to shareholders as dividends. Thirdly, KEP stressed at its Q1 2024 results briefing that “once the annual results are confirmed, we will be discussing closely with our largest shareholder, which is the government, to review possibility of dividend payout.” The company’s recent management comments send a clear message that a re-initiation of dividends for fiscal 2024 is highly probable. As a reference, the stock’s consensus forward FY 2024 and FY 2025 dividend yields are 4.2% and 9.5%, respectively as per S&P Capital IQ data. In summary, the probability of Korea Electric Power resuming dividend distributions in the near term has gotten higher considering multiple factors. Key Risks The major risk factors for KEP relate to the company’s financial prospects and shareholder return. One key risk is that Korea Electric Power takes a longer-than-expected time to re-initiate dividend payments. The other key risk is that the company’s future bottom line performance falls short of the sell-side analysts’ expectations due to a slower-than-expected ramp-up in nuclear power capacity. Closing Thoughts KEP is now trading at a 66% discount to book value and 8.4 times consensus next twelve months’ P/E as per S&P Capital IQ valuation data. The stock’s valuations are undemanding. I take the view that Korea Electric Power can trade at a higher P/E ratio and see its book value discount narrow, as its earnings recovery and dividend re-initiation catalysts are realized. As such, my Buy rating for KEP is maintained.

sekar nallalu Cryptocurrency,KEP,The Value Pendulum Korea Electric Power: Catalysts Are Still Intact (NYSE:KEP)

Related Posts

Koninklijke KPN: A Great Income Pick In The European Telecom Sector (OTCMKTS:KKPNY)

RobsonPL Koninklijke KPN (OTCPK:KKPNY) offers an interesting dividend yield and its valuation is attractive compared to peers, being one of[...]

Tron Founder Justin Sun Offers to Buy German Government’s BTC Stash Amid Price Drop – News Bytes Bitcoin News

Amid the bitcoin price decline and the German government transferring millions of dollars worth of BTC, Tron founder Justin Sun[...]

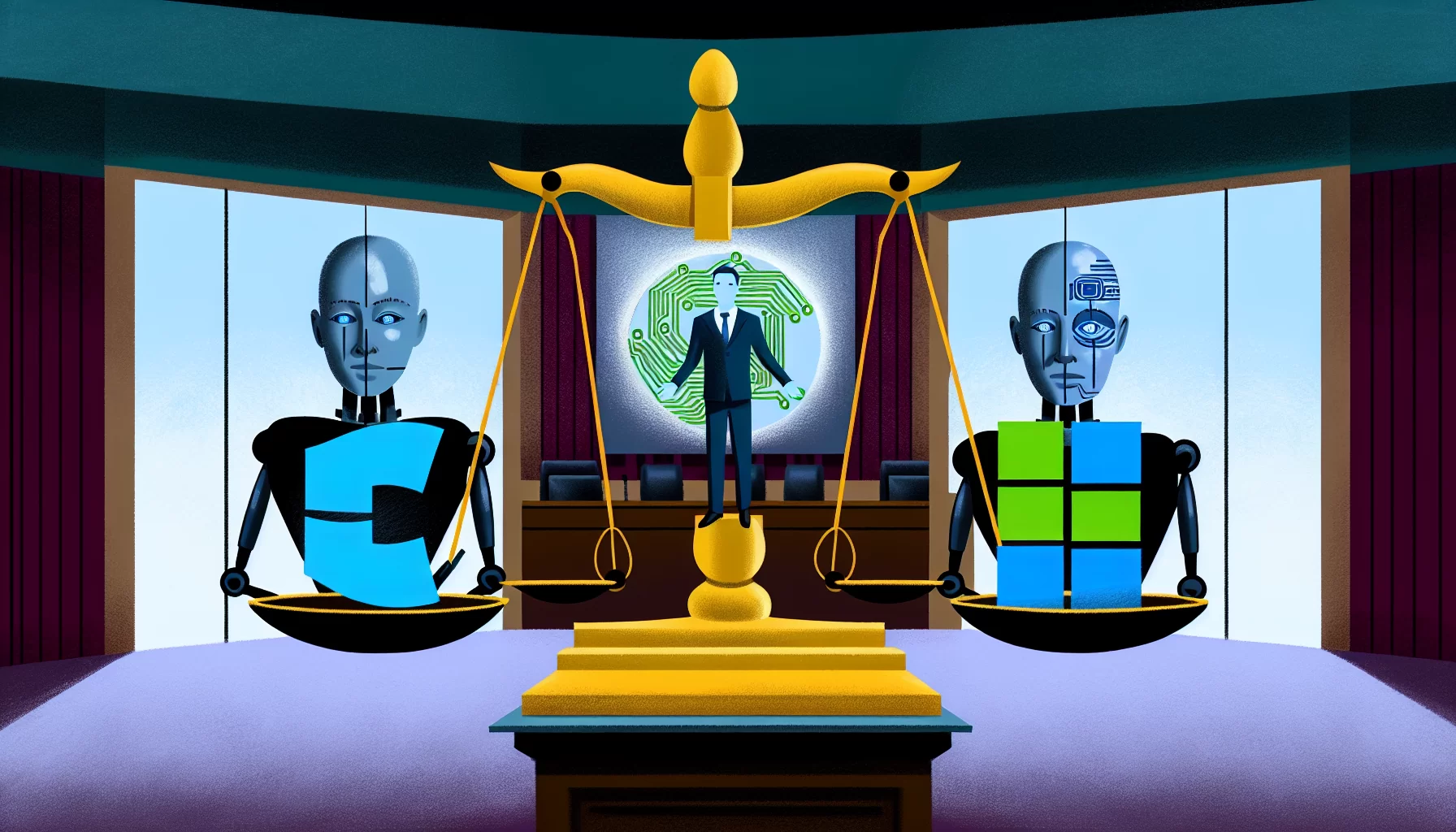

Antitrust investigations into Nvidia, Microsoft, and OpenAI: shaping the future of tech industry

As a technology enthusiast, I always strive to share useful and up-to-date information catering to technology trends, tech news, and[...]