mammuth/iStock Unreleased via Getty Images Tesco PLC (OTCPK:TSCDF) continues to maintain the guidance of a flat profit development into next year, meaning that their strategy of funneling sales into Finest, which has a positive mix effect as discussed in our previous coverage, is working. It also means that they expect revenue acceleration in the coming quarters thanks to the Euros and the Olympics. These positives are needed because there has been a major minimum wage effect of 9%. The businesses under pressure in Booker are not major profit contributors. In all, we think that the guidance is reasonable and achievable. However, Tesco trades in line with peers, and we don’t see them having any special edge at this point in a relative sense. In an absolute sense, we think that better and more obscure businesses can be bought at lower multiples on broader markets, and Tesco will always have to battle with fierce competition and pressure from wages. Q1 Trading Update As usual, Tesco does not provide profit data in its Q1 and Q3 trading updates, with more significant disclosures only happening at the H1 and FY marks. Nonetheless, the trading update is a useful moment for analysts to ask questions and for qualitative disclosure to be made. The first thing we note are the current sales changes. They are solid at around 3.4% growth in revenues, and the inflation impact is now quite minimal at not more than 2%. Volumes are strong in several of the segments, and the focus on keeping cost increases minimal has meant significant market share gains by Tesco in a continuing trend. Their policy is an Aldi price match. Our progress is clearly demonstrated by our growth in market share. With the latest Kantar read showing the highest gains for the last two years. This has been supported by 15 consecutive periods of switching gains… Ken Murphy, CEO of Tesco Sales Highlights (Q1 TU) The UK is seeing strong growth in volumes, and one of the elements at play is that they are commanding the mid-market within their shops with supermarket label Finest, which is an up-trade from their other Tesco labeled products but still more competitive in pricing than the branded products on their shelves. In our last coverage we noted that branded sellers were getting more aggressive with promotional pricing in order to compete with Tesco products, which is good for the national inflation situation and, of course, for Tesco customers, reflecting the highly competitive nature of the business. Finest is being expanded with pub classics now on offer in order to capitalise on what should be a solid couple of quarters for sports events. The Euros is the current consideration, with England continuing to get deeper in the tournament, and Tesco hopes it will get some biannual benefit from customers treating themselves when eating in to watch the games. The Olympics comes after and should offer some similar benefit. The weak segment has been Bookers. Best Food Logistics was acquired at a nominal price and provides distribution services to customers like Burger King and Pret in the UK. They are downsizing their reach to try to improve profits, since the profitability is marginal in the business. Look, I mean, on your first question on Best Food Logistics and profitability. Look, it’s not a material piece of the profit, so it’s less than a handful of million. Imran Nawaz, CFO of Tesco Tobacco is in secular decline. Taking a comp of Logista (OTCPK:CDNIF) which also does tobacco distribution, we see that tobacco distribution might be more of a profit detractor. The tobacco distribution business should have similar operating margins to the Tesco average based on this comp. But it is only around 3% of revenues still, and even annualising the 5% decline, we are only talking about 4-5 million GBP lost. Booker Breakdown (Q1 TU) They also made a new acquisition within Booker of a spirits and drinks business that they can integrate and provide wholesale. Valuation and Risks The wage increase of employees is going to cost Tesco around 300 million GBP. Sainsbury (OTCQX:JSNSF) will also be investing around 200 million GBP. Labour costs are sampled at around 9-12% of sales for grocers. The figures provided by Sainsbury and Tesco imply a lower rate at their stores, around 6% for Sainsbury and around 5% for Tesco, knowing that both are doing around 10% wage increases at their stores. However, by another calculation, 220,000 employees affected are getting a 2,000 GBP annual pay increase, which amounts to an increase in costs of around 440 million GBP for Tesco or a little less than 10% of gross profit. Regardless, to hit profit targets, we think a comprehensive 5% sales growth will need to be achieved based on last year’s annual figures before wage hikes. This estimation is based on the assumption that some commodities have deflated, and it should be possible to grow revenues while keeping incremental COGS growth outside of the wage increases flat. A more conservative guess would be to assume that Tesco manages to control gross margins at current levels of around 7% as of the FY, which would require an 8% sales increase to offset around 400 million GBP in increased wage costs, a midpoint of the given figure and our back of the envelope calculation. IS Snapshot (FY 2023 PR) With mix effects, not all of that 5% needs to be volumes. Importantly, the Euros and the Olympics should be able to accelerate revenues beyond the current 3.9% mark to be able to hit 5% for the year. More mix and less volume effects are more likely to accrete the gross margin, since volume is more operationally intensive. We think these numbers are doable, although the 8% sales growth would maybe be a stretch. But more importantly, we aren’t that happy with Tesco’s valuation. Its PE is almost exactly in line with another supermarket and grocer stock in the UK, Sainsbury. There is no relative valuation case at around 12.5x PE, and there isn’t a super absolute case either. The reciprocal of the PE is the earnings yield, and it is less than 8%. Businesses like Tesco aren’t without risks. There are significant competitive challenges at all times, reflected in the fact that a major operational policy is to make sure that all prices are matched to Aldi, which is low cost, and there is meaningful pressure from labour prices as well, reflected in the substantial wage increases they’ve had to undertake and the intensity of coverage of the cost of living crisis in the UK. We feel that there are plenty of businesses at that PE or lower that are under less pressure and face fewer potential issues in more obscure markets, avoiding the supermarket and grocery business altogether, which has a challenging industry structure. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

sekar nallalu Cryptocurrency,TSCDF,TSCDY,Valkyrie Trading Society Tesco: Euros And Olympics Should Accelerate Revenues (OTCMKTS:TSCDF)

Related Posts

HashKey Global Officially Launches Futures Trading, Pioneering a New Era in “Licensed Futures Trading”

Bermuda, Bermuda, June 19th, 2024, Chainwire Licensed digital asset exchange HashKey Global announces that it has received regulatory approval to[...]

Séisme crypto : Les altcoins sortent de l’ombre, une reprise en vue ?

14h00 ▪ 4 min de lecture ▪ par Mikaia A. Après le carnage survenu hier dans la crypto-sphère, bitcoin et[...]

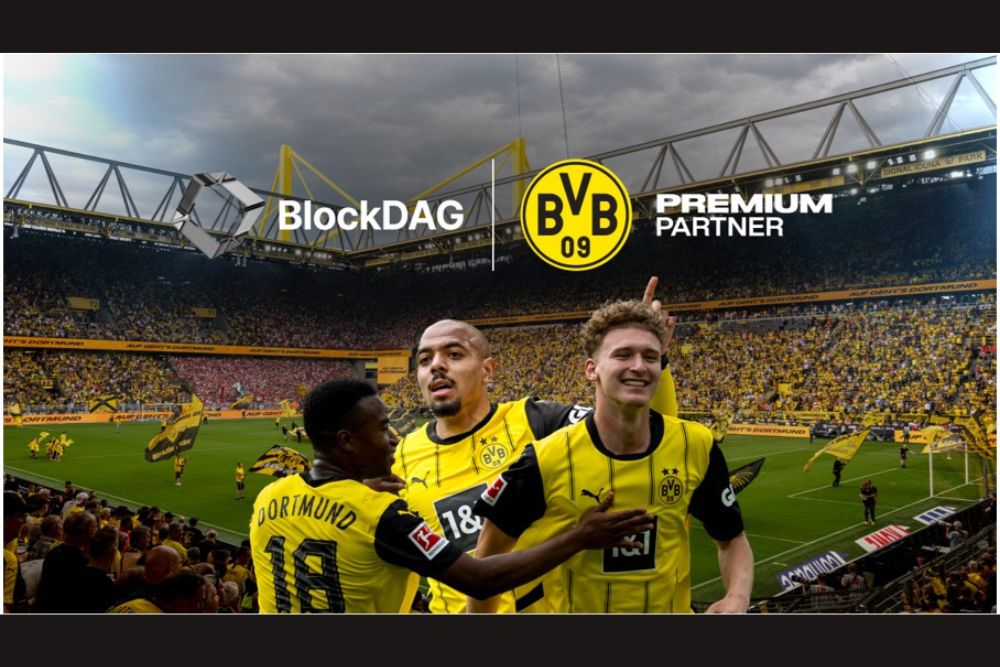

BlockDAG Becomes BVB’s Premium Partner – Tier 1 Deal Eclipses Ethereum & Shiba Inu News

As August wraps up, the crypto market is eagerly anticipating a more promising September. Ethereum (ETH) price prediction points to[...]