AI-related crypto tokens FET, AGIX, and OCEAN have performed well in the past day despite a 6.6% drop in Nvidia stocks, an AI leader often watched by the crypto community for such token trends.

At the time of writing, FET, the native token of Fetch.ai, was up 22%, trading at $1.66 in the last 24 hours, per data from CoinMarketCap. During the same period, the crypto asset’s trading volume surged over 170% to $311.6 million. Meanwhile, the token’s market cap also climbed and now stands at $1.41 billion, making it the 60th-largest cryptocurrency.

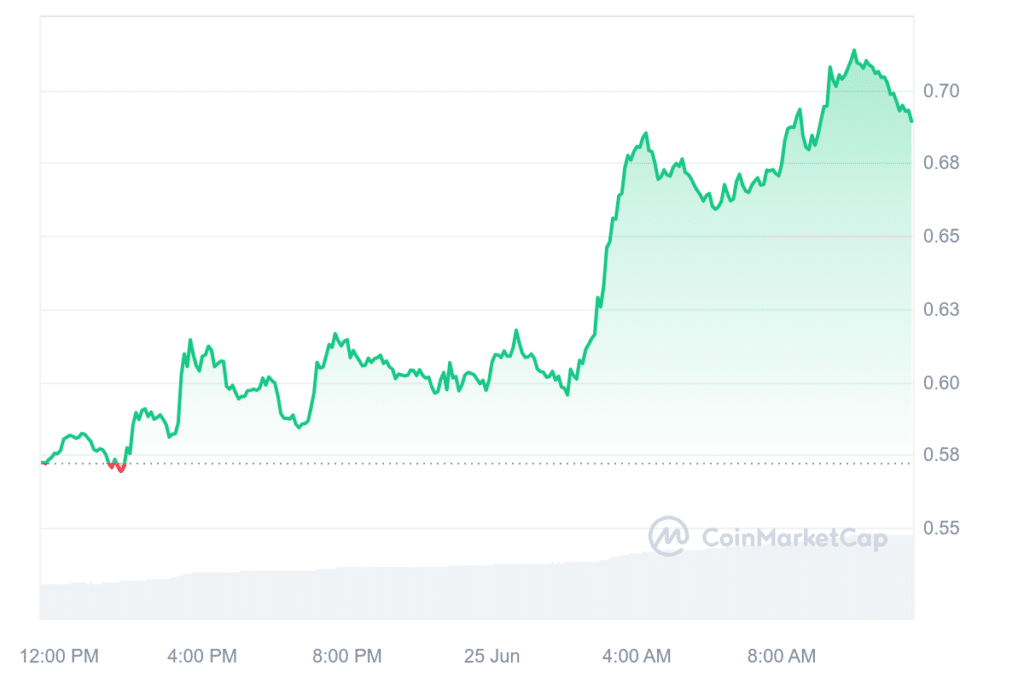

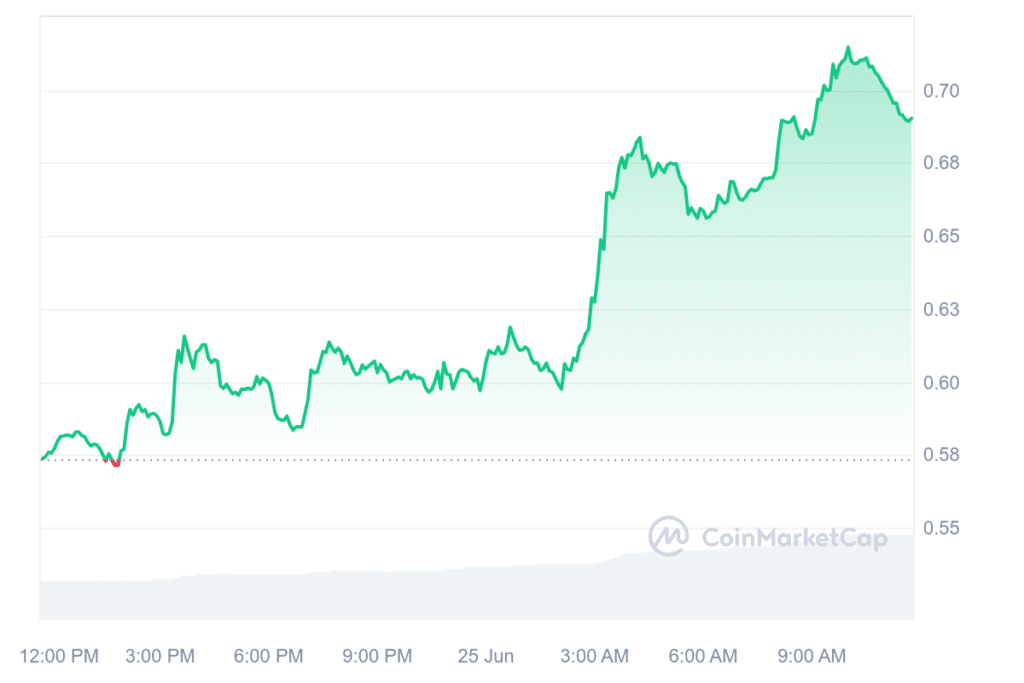

SingularityNET (AGIX) recorded a similar run. The AI token climbed 20.5% in the past 24 hours and is trading at $0.68 at the time of publication. Its market cap is hovering close to $890 million, with a daily trading volume of $148 million.

Ocean Protocol (OCEAN), the third partner of the Superintelligence Alliance (ASI) token, also surged 21% over the past day, trading at $0.69. Its market cap stands at $394 million. The trading volume for OCEAN has jumped 120% over the last 24 hours, hitting $89 million.

Meanwhile, other popular AI tokens, such as Render (RNDR) and The Graph (GRT), recorded gains ranging from 12% to 10%, respectively.

The surge in the AI tokens comes despite Nvidia stock recording a 6.68% drop on Monday, closing the day at $118.11.

The key supplier of computer chips for AI companies also experienced an 11.08% decrease in its stock price over the last five trading days, per Google Finance data.

It is worth noting that MarketWatch has named the California-based graphics processor company as one of the “three horsemen of AI.” Notably, Nvidia is developing an enterprise-level AI platform.

The rally in AI tokens also coincides with a market correction early on June 24 after the collapsed crypto exchange Mt. Gox announced plans to repay its creditors $9 billion in July.

In the past, news about Mt. Gox has caused a market sell-off. For example, last month, Bitcoin’s price fell from $70,000 to $68,500 after Arkham’s data revealed that a wallet associated with Mt. Gox began transferring over 140,000 BTC, worth approximately $9 billion, to a new wallet. The move was viewed as a preliminary step toward creditor repayments.

Bitcoin’s price fell below $59,000 following the new statement. At press time, BTC has returned to more than $61,000, but it has still been down 2% in the past 24 hours. The pioneering cryptocurrency has fallen 11% over the past month.