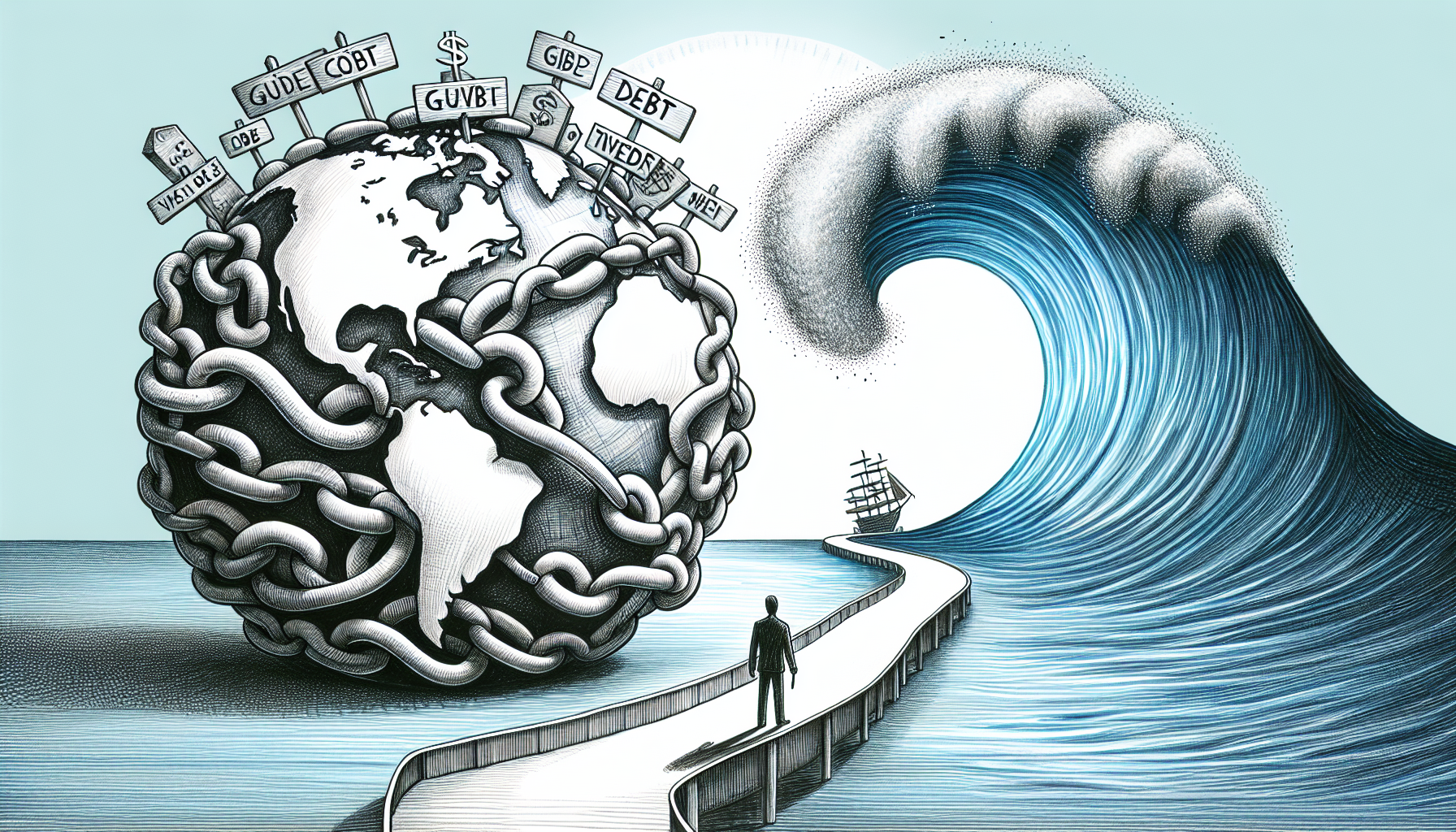

The growing burden of government debt

Both developed and developing economies worldwide have witnessed a significant surge in government debt, a trend that has been amplified by the economic repercussions of the recent global health crisis. The extensive stimulus measures implemented by governments worldwide have further swelled debt levels to unprecedented heights.

According to data recently released by the International Monetary Fund (IMF), the global public debt climbed to a staggering 98% of GDP last year, a notable increase from 84% at the end of 2019. This is bound to rise further with many countries, particularly those with less developed economies, being hit hard by pandemic-induced financial distress.

The implications for global economies

While governments’ swift actions to prop-up struggling economies have undoubtedly been necessary, the spiraling debt figures could potentially spell trouble for global economic stability. Rising debt, coupled with negative growth rates, is fueling concerns about debt sustainability, especially for those countries with limited access to borrowings.

The situation is further compounded by the fact that interest rates, especially in developed economies, are at near-zero levels. This means that, while the cost of borrowing is cheap, there is limited room for stimulating demand by lowering interest rates further.

Concerns for the future

The impact of swelling public debt is likely to be felt for years, if not decades, to come. Higher debt servicing costs will weigh heavily on government budgets, which in turn are likely to result in increased taxation, reduced public spending, or a combination of the two. Such measures will likely dampen economic growth and could result in prolonged recessions.

What is the way forward?

The road to recovery from the economic fallout from such crises is likely to be long and arduous. Effective debt management strategies are crucial and should be prioritised by policymakers globally. These should ideally encompass a combination of efforts such as boosting GDP growth, effective fiscal policies, and constructive debt restructuring where necessary.

However, it is noteworthy that that slashing government spending at the expense of critical sectors such as healthcare and education is likely to do more harm than good in the long-run.

The influence of technology

Technology can play a transformative role in improving economic efficiency and propelling growth. Harnessing the power of digital technology, particularly in sectors that are yet to fully tap its potential, can help stimulate growth. Governments should invest effectively in technology and innovation to drive productivity and regain momentum.

Given the magnitude and gravity of the situation, it is clear that tackling the problem of mounting government debt requires concerted, global efforts. Policymakers must take hold of the reins and guide their economies towards not just resilience, but sustained growth in the face of this challenge.

While the debt figures may indeed be haunting, they also provide an opportunity for global economies to reassess their financial strategies and realign their efforts for a more sustainable and inclusive economic future. Indeed, adversity often paves the way for innovation and transformation.

James Walker is a business journalist with a knack for uncovering the stories behind the numbers and trends shaping the corporate world. At 43 years old, James brings a fresh perspective to business reporting, backed by a solid foundation with a Master’s degree in Business Administration from a well-respected business school. Before stepping into the realm of journalism, James cut his teeth in the finance sector, working as an analyst for a leading investment bank. This experience provided him with an insider’s view of the financial mechanisms driving businesses forward, as well as a critical eye for what makes a company thrive or dive.

As a key business writer for an esteemed online news outlet, James covers a broad spectrum of topics, from startup culture and innovation to in-depth analyses of global market trends. His articles are renowned for their clarity, offering readers a window into the complex world of business without the jargon. James has a particular interest in how technology is reshaping business practices and consumer behavior, a theme that recurs in much of his writing.

James’s approach to business journalism is rooted in the belief that behind every company’s story is a lesson about leadership, strategy, and resilience. Through interviews with business leaders and analyses of companies’ financial health, he seeks to provide his readers with actionable insights and foresight into future trends.

In addition to his written work, James is a regular contributor to business podcasts and webinars, where he discusses the implications of current business news and offers predictions for the future. His engaging delivery and depth of knowledge make him a sought-after commentator on business issues.

James’s commitment to demystifying the business world for his readers has made him an influential voice in business journalism. He not only informs but also inspires his audience to think critically about the forces shaping our economic landscape, making him a valuable resource for professionals and casual readers alike.